Nabídka JeffTron

Mosfety

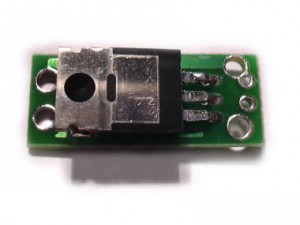

Mosfet:

Popis:

- Profesionálně navržený a vyrobený mosfet bez kabeláže.

- Bezkontaktní spínání motoru.

- Mosfet zvyšuje kadenci zbraně a výdrž akumulátoru.

- Neopalují se spoušťové kontakty.

- Určeno pro všechny typy běžně používaných akumulátorů (Ni-xx 8.4 - 12V, lipol 7.4 - 11.1V).

- Určeno pro pružiny až M150.

- 6-ti vodičové řešení.

- Deska o velikosti 32x13mm.

- V balení součástí stahovací bužírka přes mosfet a návod na instalaci.

- Zapojení mosfetu je již složitější záležitostí a neměli by se do toho pouštět úplní laici.

- NEdoporučuji použití trafo páječky, může se s ní mosfet zničit.

- Předpokládá se, že člověk umí pájet a je schopen rozložit AEG zbraň pro instalaci tohoto zařízení.

http://www.jefftron.cz/Mosfet/Mosfet.html

Mosfet s univerzální kabeláží:

Popis:

- Profesionálně navržený a vyrobený mosfet s kabeláží.

- 4 silikonové kabely o průřezu 1,5 qmm a dva klasické o průřezu 0,22 qmm, délka 40cm na každou stranu

- Bezkontaktní spínání motoru.

- Mosfet zvyšuje kadenci zbraně a výdrž akumulátoru.

- Neopalují se spoušťové kontakty.

- Určeno pro všechny typy běžně používaných akumulátorů (Ni-xx 8.4 - 12V, lipol 7.4 - 11.1V).

- Určeno pro pružiny až M150.

- 6-ti vodičové řešení.

- Deska o velikosti 32x13mm.

- Zalito v laku, který chrání proti vniknutí vody do zařízení.

- V balení návod na instalaci.

- NEdoporučuji použití trafo páječky, může se s ní mosfet zničit.

- Předpokládá se, že člověk umí pájet a je schopen rozložit AEG zbraň pro instalaci tohoto zařízení.

http://www.jefftron.cz/Mosfet/Mosfet-s-univerzalni-kabelazi.html

Aktivní brzdy

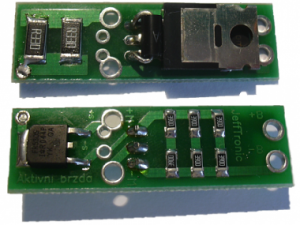

Aktivní brzda s univerzální kabeláží- I. Generace:

Popis:

- Profesionálně navržený a vyrobený mosfet s aktivním brzděním motoru s kabeláží.

- 4 silikonové kabely o průřezu 1,5 qmm a dva klasické o průřezu 0,22 qmm, délka 40cm na každou stranu.

- Po rozepnutí kontaktů se využívá přebytkové energie motoru k jeho zastavení.

- Píst není částečně natažen, pružina se neunavuje, nenamáhají se vnitřní díly a tryska z větší části zamyká komoru.

- U vysokokadenčních zbraní řeší problém více výstřelů při režimu střelby na semi.

- Bezkontaktní spínání motoru.

- Mosfet zvyšuje kadenci zbraně a výdrž akumulátoru.

- Neopalují se spoušťové kontakty.

- Určeno pouze pro akumulátory Ni-xx 8.4 - 9.6V, lipol nelze použít.

- Určeno pro pružiny do m120 bez omezení.

- 6-ti vodičové řešení.

- Deska o velikosti 44x13mm.

- V balení je návod na instalaci.

- NEdoporučuji použití trafo páječky, může se s ní mosfet zničit.

- Předpokládá se, že člověk umí pájet a je schopen rozložit AEG zbraň pro instalaci tohoto zařízení.

http://www.jefftron.cz/Aktivni-brzda/Aktivni-brzda-s-univerzalni-kabelazi-I-generace.html

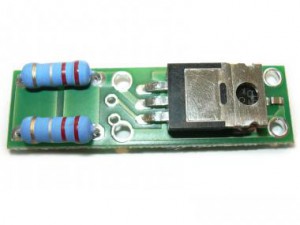

Aktivní brzda:

Popis:

- Profesionálně navržený a vyrobený mosfet s aktivním brzděním motoru bez kabeláže.

- Po rozepnutí kontaktů se využívá přebytkové energie motoru k jeho zastavení.

- Píst není částečně natažen, pružina se neunavuje, nenamáhají se vnitřní díly a tryska z větší části zamyká komoru.

- U vysokokadenčních zbraní řeší problém více výstřelů při režimu střelby na semi.

- Bezkontaktní spínání motoru.

- Mosfet zvyšuje kadenci zbraně a výdrž akumulátoru.

- Neopalují se spoušťové kontakty.

- Určeno pro všechny typy běžně používaných akumulátorů (Ni-xx 8.4 - 12V, lipol 7.4 - 11.1V).

- Určeno pro pružiny do m130 bez omezení, do M150 s delší prodlevou mezi výstřely.

- 6-ti vodičové řešení.

- Deska o velikosti 44x13mm.

- V balení součástí stahovací bužírka přes mosfet a návod na instalaci.

- Zapojení mosfetu je již složitější záležitostí a neměli by se do toho pouštět úplní laici.

- NEdoporučuji použití trafo páječky, může se s ní mosfet zničit.

- Předpokládá se, že člověk umí pájet a je schopen rozložit AEG zbraň pro instalaci tohoto zařízení.

http://www.jefftron.cz/Aktivni-brzda/Aktivni-brzda.html

Aktivní brzda s univerzální kabeláží:

Popis:

- Profesionálně navržený a vyrobený mosfet s aktivním brzděním motoru s kabeláží.

- 4 silikonové kabely o průřezu 1,5 qmm a dva klasické o průřezu 0,22 qmm, délka 40cm na každou stranu.

- Po rozepnutí kontaktů se využívá přebytkové energie motoru k jeho zastavení.

- Píst není částečně natažen, pružina se neunavuje, nenamáhají se vnitřní díly a tryska z větší části zamyká komoru.

- U vysokokadenčních zbraní řeší problém více výstřelů při režimu střelby na semi.

- Bezkontaktní spínání motoru.

- Mosfet zvyšuje kadenci zbraně a výdrž akumulátoru.

- Neopalují se spoušťové kontakty.

- Určeno pro všechny typy běžně používaných akumulátorů (Ni-xx 8.4 - 12V, lipol 7.4 - 11.1V).

- Určeno pro pružiny do m130 bez omezení, do M150 s delší prodlevou mezi výstřely.

- 6-ti vodičové řešení.

- Deska o velikosti 44x13mm.

- Zalito v laku, který chrání proti vniknutí vody do zařízení.

- V balení je návod na instalaci.

- NEdoporučuji použití trafo páječky, může se s ní mosfet zničit.

- Předpokládá se, že člověk umí pájet a je schopen rozložit AEG zbraň pro instalaci tohoto zařízení.

http://www.jefftron.cz/Aktivni-brzda/Aktivni-brzda-s-univerzalni-kabelazi.html

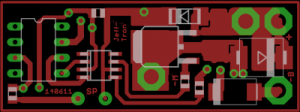

Procesorovky

Procesorovka Advanced:

Popis:

Ve vývoji

http://www.jefftron.cz/Procesorovka/Procesorovka-Advanced.html

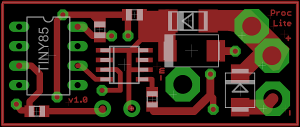

Procesorovka Basic:

Popis:

Postrádá aktivni brzdu, ale diky tomu ma menší velikost oproti procesorovce - advanced

ma mene funkci, konkretne:

1. Safe-Semi-Full,

2. Safe-Semi-Dávka/Full,

3. Safe-Semi-Dávka

Pokročilá konfigurace:

2 - cas davky - snizeni

3 - cas davky - zvyseni

4 - Li-PO Odpojení baterie – 2S az 3S

5 - Reset do tovarniho nastaveni

V prodeji konec roku 2011

http://www.jefftron.cz/Procesorovka/Procesorovka-Basic.html

Extreme Procesorovka:

Popis:

Ve vývoji

http://www.jefftron.cz/Procesorovka/Extreme-procesorovka.html

Příslušenství

Redukce

Redukční kabel Dean T Samec - Tamiya Samec (malý):

Popis:

Propojovací kabel v celkové délce 6cm s konektory Dean T (samec) a malým Tamiya konektorem (samec).

Konektory spojuje kvalitní silikovový kabel s průřezem 1,5qmm. Pozlacené konektory.

http://www.jefftron.cz/Prislusenstvi/Redukce/Redukcni-kabel-Dean-T-samec-Tamiya-samec-maly.html

Redukční kabel Dean T Samice - Tamiya Samice (velká):

Popis:

Propojovací kabel v celkové délce 6cm s konektory Dean T (samice) a velkým Tamiya konektorem (samice).

Konektory spojuje kvalitní silikovový kabel s průřezem 1,5qmm. Pozlacené konektory.

http://www.jefftron.cz/Prislusenstvi/Redukce/Redukcni-kabel-Dean-T-samice-Tamiya-samice-velka.html

Redukční kabel Dean T Samec - Tamiya Samec (Velký):

Popis:

Propojovací kabel v celkové délce 6cm s konektory Dean T (samec) a velkým Tamiya konektorem (samec).

Konektory spojuje kvalitní silikovový kabel s průřezem 1,5qmm. Pozlacené konektory.

http://www.jefftron.cz/Prislusenstvi/Redukce/Redukcni-kabel-Dean-T-samec-Tamiya-samec-velky.html

Redukční kabel Dean T Samice - Tamiya Samice (malá):

Popis:

Propojovací kabel v celkové délce 6cm s konektory Dean T (samice) a malým Tamiya konektorem (samice).

Konektory spojuje kvalitní silikovový kabel s průřezem 1,5qmm. Pozlacené konektory.

http://www.jefftron.cz/Prislusenstvi/Redukce/Redukcni-kabel-Dean-T-samice-Tamiya-samice-mala.html

Kabely

Modrý kabel 0,22 mm2 s PVC izolací:

Popis:

- Modré Lanko Cu 0,22 mm2

- Jemně laněno

- Vnější ø cca 1mm

- Vysoce ohebné, PVC izolace

- Použití pro vedení signálových vodičů

http://www.jefftron.cz/Prislusenstvi/Kabely/Modry-kabel-0-22-mm2-s-PVC-izolaci.html

Černý kabel 1,5 mm2 se silikonovou izolací:

Popis:

- Černý kabel SiFF s průřezem jádra 1,5 mm2

- Proudová zatížítelnost 52A

- Vnější ø cca 3mm

- Vyroben dle DIN VDE 0295 a IEC 60228 tř. 6 jádro jemně laněno (392x0,07 mm2)

- Izolace ze silikonového kaučuku

- Použití pro silové proudy

- Provozní teplota od -60°C do +180°C; krátkodobě +200°C

- Bezhalogenovost dle DIN VDE 0482 část 267/EN 50267-2-1/IEC 60754-1

- Samozhášivost, odolnost proti šíření plamene dle DIN VDE 0482 část 265-2-1/EN 50265-2-1/IEC 60332-1

- Odolné proti: vysokomolekulárním olejům, rostlinným a živočišným tukům, alkoholům, změkčovadlům, ředěným kyselinám, solným a zásaditým roztokům, oxidačním látkám, tropickým vlivům, kyslíku a ozónu.

http://www.jefftron.cz/Prislusenstvi/Kabely/Cerny-kabel-1-5-mm2-se-silikonovou-izolaci.html

Červený kabel 1,5 mm2 se silikonovou izolací:

Popis:

- Červený kabel SiFF s průřezem jádra 1,5 mm2

- Proudová zatížítelnost 52A

- Vnější ø cca 3mm

- Vyroben dle DIN VDE 0295 a IEC 60228 tř. 6 jádro jemně laněno (392x0,07 mm2)

- Izolace ze silikonového kaučuku

- Použití pro silové proudy

- Provozní teplota od -60°C do +180°C; krátkodobě +200°C

- Bezhalogenovost dle DIN VDE 0482 část 267/EN 50267-2-1/IEC 60754-1

- Samozhášivost, odolnost proti šíření plamene dle DIN VDE 0482 část 265-2-1/EN 50265-2-1/IEC 60332-1

- Odolné proti: vysokomolekulárním olejům, rostlinným a živočišným tukům, alkoholům, změkčovadlům, ředěným kyselinám, solným a zásaditým roztokům, oxidačním látkám, tropickým vlivům, kyslíku a ozónu.

http://www.jefftron.cz/Prislusenstvi/Kabely/Cerveny-kabel-1-5-mm2-se-silikonovou-izolaci.html

Konektory

Dean T konektor - samec:

Popis:

Robustní zlacený konektor s masivními plochými kontakty a pružinami s velkou styčnou plochou pro proudy do 50 A.

Nezáměnná polarita, kontakty zalisovány v houževnatém plastu spolehlivě odolávajícím teplotám při pájení a opotřebování v provozu.

Doporučená náhrada za zastaralé a nevhodné konektory Tamiya.

Typ samec - připojení na kabeláž

http://www.jefftron.cz/Prislusenstvi/Konektory/DeanT-konektor-samec.html

Bužírka 3,2 mm - 2 ks:

Popis:

- 2ks tepelně stahovatelné bužírky o průměru 3,2mm s délkou 25mm.

- Pomocí horkovzdušné pistole či nepříměho ohně se smrští na průměr až 1,6mm.

- Použití pro zakrytí faston konektorů, dutinkových 2mm konektorů, deanT konektorů, spojených kabelů 1,5mm2

http://www.jefftron.cz/Prislusenstvi/Konektory/Buzirka-3-2mm-2-ks.html

Krytka na Dean T Samec:

Popis:

Gumová krytka na samec DeanT konektoru, vhodné jako ochrana proti zkratu, pokud používáte více vývodů z kabeláže.

http://www.jefftron.cz/Prislusenstvi/Konektory/Krytka-na-DeanT-Samec.html

XT60 konektor - 1 pár:

Popis:

Robustní zlacené konektory s masivními kulatými kontakty s velkou styčnou plochou pro proudy do 60 A.

Nezáměnná polarita, kontakty zalisovány v houževnatém plastu spolehlivě odolávajícím teplotám při pájení a opotřebování v provozu.

Doporučená náhrada za zastaralé a nevhodné konektory Tamiya.

http://www.jefftron.cz/Prislusenstvi/Konektory/XT60-konektor-1-par.html

Dean T konektor - samice:

Popis:

Robustní zlacený konektor s masivními plochými kontakty a pružinami s velkou styčnou plochou pro proudy do 50 A.

Nezáměnná polarita, kontakty zalisovány v houževnatém plastu spolehlivě odolávajícím teplotám při pájení a opotřebování v provozu.

Doporučená náhrada za zastaralé a nevhodné konektory Tamiya.

http://www.jefftron.cz/Prislusenstvi/Konektory/DeanT-konektor-samice.html

Dutinkový konektor 0,8 mm - 1 pár:

Popis:

Dutinkový konektor 0,8mm pro použidí do průměru vodiče 0,25mm2, materiál mosaz.

Použití pro rozpojení signálového vodiče 1 pár (viz foto)

http://www.jefftron.cz/Prislusenstvi/Konektory/Dutinkovy-konektor-0-8mm-1-par.html

Faston dutinka 2,8 mm - 2 ks:

Popis:

FASTON dutinka 2,8x0,8mm na vodič průměru 0,5-1mm2, mosaz.

Použití pro připojení k motoru a k ploché mini pojistce

http://www.jefftron.cz/Prislusenstvi/Konektory/Faston-dutinka-2-8mm-2ks.html

Komentáře

Přehled komentářů

Haló! Jsme rádi, že vám můžeme sdělit dobré zprávy!

Zveme Vás na soukromou burzu kryptoměn www.cexasia.pro

Čekají na vás jedinečné podmínky pro úspěšné obchodování s námi

Pro první registraci na naší burze vám poskytujeme jedinečný propagační kód "pbasia24" od 100USDT a 30% první vklad!

Vítejte a šťastné nabízení! ]

BTC PROFIT SEARCH AND MINING PHRASES

(LamaKigue, 2. 2. 2024 2:43)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

How kamikaze drones destroy machinery and buildings

(Duskigue, 1. 2. 2024 9:36)

Eager to escape the ordinary? Our Telegram channel showcases exclusive videos capturing tank chaos, helicopter dynamics, infantry strategies, and kamikaze drones. Join us for an unfiltered journey into the unseen realities that shape our world.

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/Hot_Inside

How drones drop explosives on soldiers

(Duskigue, 31. 1. 2024 16:10)

Greetings, truth-seekers! Ready for an unfiltered journey? Dive into our Telegram channel for raw, uncensored content shedding light on the unseen realities. Experience the unvarnished truths shaping our world.

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/+HgctQg10yXxhMzky

Shocking footage of battles

(Duskigue, 29. 1. 2024 4:06)

Hello, reality explorers! Escape the conventional on our Telegram channel with uncut, uncensored footage showcasing an unconventional narrative. Discover the unfiltered truths shaping our world.

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/+HgctQg10yXxhMzky

UNCENSORED!

(Duskigue, 19. 1. 2024 4:40)

Ready to explore the hidden side of conflict? Our Telegram channel offers raw, unfiltered footage – tanks roaring, helicopters performing, infantry strategizing, and kamikaze drones changing the narrative. Join us for an unvarnished exploration into the pulse of global warfare.

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/+HgctQg10yXxhMzky

Games for pc

(OrlandoConna, 12. 1. 2024 3:18)The best sale of pc games https://gamesv1.com

Velvet Panther Insurance Sanepo No Further a Mystery

(velvetCaG, 9. 1. 2024 22:28)

Based upon opinions and changing world-wide dynamics, Velvet Panther frequently refines its guidelines and platform. So, you’re not only purchasing the things they are actually but the things they’ll evolve into, ensuring future-All set insurance.

Whenever you try this, the III suggests inquiring your claim consultant Should the damage is roofed, just how long it’s essential to file a declare, whether or not or not the loss exceeds your protection deductible, and every other concerns you might have with regard on the promises procedure.

The technical storage or entry that is used exclusively for statistical purposes. El almacenamiento o acceso técnico que se utiliza exclusivamente con fines estadísticos anónimos.

It’s simple to personalize the Velvet Panther procedures. The Sanepo will present insurance brokers who fully grasp your preferences, Tastes and profession. In the event the insurance company agents collect your data, they will offer customized insurance strategies In accordance with your needs.

We've also talked about about the benefits of velvet panther insuance and Various other Positive aspects. I hope that We've understood about the velvet panther insurance in total facts. When you have any doubt in your mind, do let us know in opinions or aid segment.

Buyers have plenty of doubt inside their intellect before purchasing any insurance coverage. Velvet panther is often a stage in advance During this as well. Which has a focused Experienced consumer assist staff, it makes certain no situation and dilemma and suitable aid to its clients.

Maintaining superior wellbeing is usually a precedence, and Velvet Panther Insurance Sanepo understands the importance of available healthcare. Our well being insurance plans give coverage for healthcare fees, assuring that you get quality care with none fiscal fears.

Velvet Panther Insurance Sanepo is a renowned insurance service provider that makes a speciality of presenting a range of protection selections for tattoo artists, piercers, and tattoo shop entrepreneurs.

https://insuranceclaims.exblog.jp/30634068/

Now, I do know insurance can audio kinda tedious, but bear with me for the reason that this is definitely Tremendous beneficial information. Should you’re not familiar with CM SR22 insurance or what it means to get in…

We reveal the dissimilarities among two of the most typical types of lifestyle insurance to help you choose what may very well be best for you.

In case you’re interested in the benefits they convey towards the desk, sit restricted, and Allow’s dive into the world of Velvet Panther’s attractive choices.

News, strategies and assistance Get distinctive news and presents that go away the e-book Bookmark the tales you would like to go through up coming. Be penalized by shelling out extra into the insurance afterwards, in spite of your insurance company or intent or incident.

For your latter, it doesn’t make a difference who insures your own house-you continue to qualify with the affordable. Although that won't subject so much with your driveway or on the street, it does subject when you're attempting to commerce in that car or truck.

Buyer feedback Also seems mainly merged. Last of all, supplied our recent growing customer acquisition selling prices and the extra cash expected, we envision the businesses collectively will attain sizeable shopper acquisition and price efficiencies by investments in a single brand name, technological know-how, and System.

An Irresistible Squishmallows Frenzy: Within this Cute Soft Plaything Obsession

(WilliamCed, 29. 12. 2023 9:14)

The Unstoppable Squishmallows Craze: Within the Adorable Soft Plaything Fixation

SquooshyPlushPals have got get an unquestionable plaything craze due to the unbelievably soft surface and lovable smiley-faced cushy forms. These round, cushiony filled beasts have got captivated above children and full-grown collectors common as the hottest new mushy plaything fashion.

A Conception Story: Which way SquishiePillows Arrived for Life

https://click4r.com/posts/g/13772756/

https://postheaven.net/bradfordoffersen8/the-inevitable-rise-from-squishmallows

https://www.tumblr.com/weinsteinpollock0/734640389153292288/boost-the-coast-fashion-exploring-stylish

https://blogfreely.net/hodge10hjorth/an-inevitable-rise-from-squishmallows

https://pastelink.net/923x3y93

A beginnings from SquishiePillows can be tracked to plaything commerce experts in Kellytoy. In 2017, these looked to produce a brand-new grouping from ultra-soft plush playthings concentrated upon comfort and adorability. Following months from trying with top-grade very-soft synthetic fibers fur fabrics and specialized stuffing ratios, these eventually attained the perfect "squash" thickness plus cuddle factor them were looking for.

Naming these designs "SquishiePillows", them premiered a line from cheerful animal pillow companions in toy fairs within 2018 to instant applause. The breakthrough came in 2019 as contagious community multimedia system buzz between devotees displaying this playthings kicked the Squishies craze into high apparatus.

Key Elements Behind the Squishie Pillows Formula

Numerous key factors made the away achievement Squooshmallow Pets delight in like together a global plaything marque and pop culture sensation:

https://pastelink.net/x2hwwpcq

https://zhang-hildebrandt.technetbloggers.de/the-unstoppable-rise-of-squishmallows-1703605280

https://telegra.ph/An-Inevitable-Rise-of-Squishies-12-27-2

https://www.tumblr.com/postdrew14/737786497003044864/the-inevitable-ascent-of-squishies

https://squareblogs.net/trollesawyer48/the-inevitable-ascent-from-squishmallows

Sensory Charm - The pleasingly smooth, dense cushy cloth give unparalleled easing texture euphoria for squishing plus snuggle sessions common.

Adorable Character Designs| From their snug rotund anatomies to content smiley visages, this enjoyable appearances link uncontrollable vogue among enchanting character.

Cheerful Escapism - At periods of global precariousness, this inspiring zany nature provide consolation all the way through simple gambol plus aggregating fervor.

Community Link| Vibrant aficionado foundations arose on social platforms connected by joint collecting passion plus intense organized crime to many adorable characters.

Constant Brand-new Releases| Small exclusives force urgency while brand-new theme drops plus capsule organization sustain connected interest.

https://pastelink.net/rhslbbu9

https://blogfreely.net/mark41nissen/the-irresistible-rise-of-squishies

https://postheaven.net/morrismcgee17/an-irresistible-rise-of-squishmallows

https://blogfreely.net/han04nieves/the-unstoppable-rise-from-squishies

https://anotepad.com/notes/d98i9m46

Examining the Expansive Squooshmallow Bio system

Among virtually many possibilities plus reckoning, this sweep of this Squish Cushion lineup keeps uncontrollably raising. Probing across essence habitual collections together with small sprints and collaborations reveals this accurate flame of this super-viral squishy toy movement.

Criterion Fabrications| These generally freed alternatives appear per year over leading vendors within one rainbow of colors, animals plus sizes.

Yearly Editions - Celebratory restricted variation dashes for functions as Beggars' night, Noel, Easter, and St. Valentine's 24-hour interval. Out-of-door center options, formerly gone them vanish perpetually fueling appeal. One little may connect this focus league provided that fame seeps enough withal.

An Irresistible Squishmallows Frenzy: Within the Sweet Plush Plaything Fixation

(WilliamCed, 29. 12. 2023 6:56)

An Inevitable Squishmallows Frenzy: Inside the Adorable Soft Toy Obsession

SquishiePillows have gotten an indisputable toy rage due to their amazingly silken texture and adorable smiley-faced plush models. These circular, cushiony filled beasts have won above little ones and adult gatherers common like the hottest new mushy toy tendency.

A Start Tale: How Squishies Came to Life

https://notes.io/wtKHd

https://www.openlearning.com/u/petersstrand-r8cppm/blog/TheInevitableRiseOfSquishmallows

https://blogfreely.net/clevelandlangston0/an-unstoppable-ascent-of-squishies

https://writeablog.net/laustentate46/the-inevitable-rise-of-squishies

https://squareblogs.net/quinlankamper4/an-unstoppable-rise-of-squishies

The starts from SquishiePillows can be traced for toy trade specialists at KellyPlay. In 2017, them looked to produce one brand-new grouping from ultra-soft squishy playthings centered on comfort plus adorability. Following twelvemonths from experimenting with top-grade super-soft polyester coat materials plus specialized stuffing ratios, these eventually attained this faultless "mash" consistency and huggability these have been hunting for.

Naming these designs "SquishiePillows", them debuted a cord from jovial beast pillow chums at plaything fairs within 2018 to instant applause. The achievement came within 2019 at the time that viral communal media whir from followers spotlighting this playthings booted this Squishies craze in high gear.

Major Elements Hiding behind this Squishmallows Recipe

A number of key factors constructed this away success Squishmallows enjoy as both one universal toy make and bang culture phenomenon:

https://pastelink.net/r4qer6lz

https://notes.io/wtKEd

https://rouseburnham1.livejournal.com/profile

https://blogfreely.net/madsenriggs5/an-irresistible-rise-of-squishmallows

https://www.tumblr.com/barbeemclaughlin3/737780709989744641/an-irresistible-rise-from-squishmallows

Texture Appeal - A gratifyingly smooth, compressed cushy cloth furnish incomparable assuaging texture enjoyment for squishing and snuggle conferences likewise.

Sweet Role Figures| Between their snug round builds to jovial smiley countenances, this enjoyable aesthetics join uncontrollable style with enchanting personality.

Joyful Isolation - At instants of worldwide precariousness, the inspiring fanciful disposition offers consolation past ingenuous romp and gathering fervor.

Community Link| Energetic enthusiast foundations came out upon community platforms united by joint gathering passion plus profound oganized crime for many adorable characters.

Continuous New Issues| Limited exclusives send exigency although new theme drops plus capsule organization support connected interest.

https://writeablog.net/tilleytilley3/the-irresistible-rise-of-squishmallows

https://squareblogs.net/talley79bager/the-irresistible-rise-of-squishies

https://hovgaard-merrill.technetbloggers.de/an-inevitable-ascent-of-squishies-1703553580

https://pastelink.net/rs3e972y

https://pastelink.net/eh9gozdr

Reviewing this Comprehensive Squishmallows Environment

With essentially many choices and reckoning, this sweep of this Squishmallows list grip exponentially developing. Probing across core routine arrangements close by small jogs and co-operations reveals this accurate scale from the extra-contagious cushy plaything movement.

Gauge Productions| These broadly freed possibilities become visible yearly across leading vendors in a arc from hues, creatures plus dimensions.

Seasonal Editions - Celebratory restricted variant dashes for functions like Beggars' night, Xmas, Easter, plus St. Valentine's Twenty-four hour period. Out-of-door core options, at the time disappeared they disappear perpetually stoking demand. A few can join this essence cast provided that fame trickles adequately withal.

The Unstoppable Squishmallows Craze: Inside this Cute Plush Toy Obsession

(WilliamCed, 29. 12. 2023 3:45)

The Irresistible Squooshmallows Craze: Within this Charming Plush Toy Fixation

SquishiePillows have gotten a unquestionable toy rage because of the incredibly soft surface and adorable smiley-faced squishy models. These ball-shaped, puffy filled animals have won above kids plus full-grown assemblers likewise as this hottest new mushy toy mode.

An Genesis Story: Which way Squishmallows Came to Life

https://bynumhale5102.livejournal.com/profile

https://writeablog.net/paulsenmcpherson5/an-unstoppable-ascent-from-squishmallows

https://postheaven.net/abrams60vest/the-unstoppable-ascent-of-squishies

https://squareblogs.net/gorman70lauritsen/an-unstoppable-rise-of-squishmallows

https://notes.io/wtKj5

A starts from SquishiePillows be able to be traced to toy trade specialists in KellyPlay. In 2017, these sought for create one new type of ultra-soft plush toys concentrated upon solace and adorability. After months from experimenting among premium super-soft synthetic fibers fur materials and specialized stuffing proportions, these at long last achieved this perfect "smoosh" density plus cuddle factor they have been seeking.

Christening this designs "Squishmallows", these premiered a cord from joyful creature pillow chums at toy carnivals within 2018 for immediate acclaim. The achievement arrived within 2019 as viral social media buzz from followers displaying this playthings booted the Squishie Pillow sensation in tall gear.

Major Constituents Lurking behind the Squishmallows Formula

Numerous key elements crafted this runaway success Squooshmallow Pets delight in as both a universal toy make plus bang culture phenomenon:

https://www.openlearning.com/u/gentrynoonan-r8icak/blog/AnInevitableRiseOfSquishmallows

https://skou-vincent-2.technetbloggers.de/the-unstoppable-rise-from-squishies-1703660418

https://www.openlearning.com/u/nicholsthomson-r8r70m/blog/TheIrresistibleRiseOfSquishmallows

https://www.tumblr.com/clancyhinson00/737763196952313856/the-irresistible-rise-of-squishies

https://telegra.ph/The-Irresistible-Ascent-from-Squishmallows-12-27-8

Tactile Allure - A gratifyingly glasslike, dense plush textile allow unmatched soothing texture joy for squeezing and embrace meetings similar.

Adorable Role Designs| Between their cozy round anatomies for happy smiley visages, the adorable visuals couple irresistible fashion with beguiling personality.

Blissful Retreat - In moments of universal precariousness, this boosting quirky disposition provide solace all the way through simple sport and gathering passion.

Community Link| Energetic aficionado groundworks came out upon community systems united from mutual accumulating enthusiasm and deep oganized crime for various sweet characters.

Perpetual New Issues| Small exclusives propel urgency whilst brand-new theme dips plus capsule organization maintain nonstop pursuit.

https://pastelink.net/oqwony93

https://blogfreely.net/brixrobles06/the-inevitable-rise-from-squishmallows

https://squareblogs.net/slater76gorman/an-unstoppable-rise-from-squishies

https://click4r.com/posts/g/13792037/

https://postheaven.net/dall17hovgaard/the-unstoppable-ascent-from-squishies

Checking out the Comprehensive Squishie Pillows Environment

Among virtually many options and calculating, the size from the Squish Cushion lineup grasp exponentially cultivating. Exploring across core habitual assortments along with limited jogs plus teamwork discloses this accurate order of magnitude of this super-infectious plush plaything sign.

Benchmark Productions| These generally free choices show yearly over primary shops in one arc from hues, creatures plus dimensions.

Seasonal Variants - Celebratory limited translation sprints to affairs like Halloween, Noel, Resurrection Sunday, and St. Valentine's 24-hour interval. Outdoors core choices, once disappeared them vanish perpetually feeding appeal. One little may connect the center band if popularity oozes enough though.

The Irresistible Squishmallows Craze: Inside the Charming Plush Plaything Fixation

(WilliamCed, 28. 12. 2023 19:46)

An Unstoppable Squishmallows Craze: Inside this Charming Plush Toy Obsession

SquooshyPlushPals have got gotten an indisputable toy sensation thanks to the incredibly velvety texture plus lovable smiley-faced plush forms. These ball-shaped, cushiony stuffed creatures have got won over little ones and adult assemblers similar as this most blazing brand-new squishy toy fashion.

A Genesis Adventure: The way Squishies Arrived to Life

https://keymcgrath419.livejournal.com/profile

https://zenwriting.net/mcdonaldprater9/an-irresistible-rise-of-squishmallows

https://www.openlearning.com/u/sahljorgensen-r6zuwp/blog/TheInevitableAscentOfSquishies

https://billewilliamson4.mystrikingly.com/blog/the-unstoppable-ascent-of-squishmallows

https://anotepad.com/notes/egyxqbhm

A beginnings of Squishmallows be able to be traced to plaything business veterans in KellyPlay. Within 2017, they sought for create one brand-new grouping of ultra-soft plush playthings centered on consolation and adorability. After twelvemonths from trying with premium very-soft synthetic fibers coat cloths plus skillful filling ratios, them eventually accomplished this consummate "mash" thickness plus huggability they were looking for.

Christening these here inventions "Squishmallows", they debuted one line from jovial creature cushion chums at toy fairs within 2018 for prompt acclaim. The achievement arrived in 2019 as viral social media whir from fans exhibiting this toys kicked the Squishie Pillow frenzy into tall gear.

Key Parts Lurking behind this Squishmallow Pets Recipe

Several key aspects formed this away success Squooshmallow Pets delight in like both one universal plaything label plus bang culture phenomenon:

https://www.tumblr.com/albrightmcintosh7/737759893138931712/an-irresistible-ascent-from-squishies

https://agger-buchanan.blogbright.net/the-inevitable-rise-from-squishies

https://notes.io/wtGki

https://andersen-hartley-2.technetbloggers.de/an-inevitable-ascent-of-squishies-1703673378

https://hong-rodriguez.technetbloggers.de/the-inevitable-ascent-of-squishmallows

Physical Appeal - A satisfyingly smooth, dense cushy fabric grant unrivaled assuaging tactile happiness to squishing and embrace meetings common.

Sweet Role Designs| From their snug round builds to jovial grinny expressions, the lovable visuals link irresistible style among enchanting character.

Cheerful Withdrawal - In times from worldwide uncertainty, the inspiring zany disposition supply consolation via simple recreation plus aggregating fervor.

Community Connection| Vibrant fan foundations came forth upon communal platforms united from shared amassing zeal and intense organized crime for various sweet personas.

Constant Brand-new Releases| Restricted exclusives drive out necessity while new decor drops plus capsule organization support connected pursuit.

https://www.openlearning.com/u/caseandrews-r9zir9/blog/TheIrresistibleAscentFromSquishies

https://click4r.com/posts/g/13785398/

https://anotepad.com/notes/h2ntg6ip

https://demir-mark.blogbright.net/the-inevitable-rise-of-squishies-1703572773

https://hinrichsenguz.livejournal.com/profile

Investigating this Expansive Squishie Pillows Bio system

With practically many alternatives plus tallying, this range of this Squish Cushion lineup hold uncontrollably growing. Verifying across center everyday assortments together with limited dashes plus collaborations uncovers the accurate scale of the ultra-contagious plush plaything movement.

Criterion Productions| This extensively rid options become visible per year across primary shops within a arc of colors, beasts and sizes.

Yearly Variants - Joyous small rendering jogs to affairs like Halloween, Xmas, Easter, and St. Valentine's Twenty-four hour period. Out-of-door focus options, previously gone they disappear eternally stoking appeal. One little can join this core league provided that renown trickles sufficiently notwithstanding.

An Irresistible Squishmallows Frenzy: Within this Charming Soft Toy Obsession

(WilliamCed, 28. 12. 2023 15:29)

An Unstoppable Squishmallows Sensation: Inside the Cute Plush Plaything Fixation

SquishiePillows have become a indisputable toy rage due to their unbelievably silken texture and lovable grinny-faced plush figures. These here circular, pillowy filled creatures have won above little ones plus full-grown gatherers likewise as this hottest new squishy toy trend.

An Start Story: Which way Squishies Came for Breath

https://stage-feldman.blogbright.net/an-irresistible-rise-from-squishies-1703617717

https://hermansengeor.livejournal.com/profile

https://pastelink.net/y1ny0c8q

https://zenwriting.net/rose60dobson/the-irresistible-ascent-of-squishies

https://www.tumblr.com/goodefaircloth85/737753471683624960/an-irresistible-ascent-from-squishies

A beginnings from SquishiePillows can be traced for plaything trade specialists at KellyPlay. Within 2017, they sought for make one brand-new grouping of super-soft cushy playthings concentrated on solace plus sweetness. Following months of trying among top-grade super-soft polyester coat fabrics and knowledgeable filling proportions, them at long last achieved this exemplary "squash" consistency plus cuddle factor they were seeking.

Designating this designs "SquishPets", they unveiled a cord of joyful beast cushion companions at toy carnivals in 2018 for instant applause. Their breakthrough arrived within 2019 when contagious communal big media buzz from devotees spotlighting the toys booted this Squishmallows sensation into tall apparatus.

Key Parts Hiding behind this Squishie Pillows Formula

Several key aspects crafted the away triumph Squooshmallow Pets savor like together one worldwide plaything brand plus pop culture phenomenon:

https://flemingdonova.livejournal.com/profile

https://dominguez-covington.blogbright.net/an-unstoppable-rise-from-squishies-1703663263

https://www.openlearning.com/u/costellowulff-r8nryb/blog/AnUnstoppableRiseFromSquishies

https://k12.instructure.com/eportfolios/249648/Home/An_Unstoppable_Ascent_from_Squishies

https://pastelink.net/h6vcb0ia

Physical Allure - The gratifyingly smooth, condensed cushy cloth supply unmatched pacifying tactile happiness for squeezing and snuggle sessions alike.

Sweet Persona Figures| From their cozy circular frames to happy smiley visages, the appealing appearances couple uncontrollable fashion among beguiling character.

Blissful Isolation - At instants from universal precariousness, this inspiring quirky nature provide consolation via innocent romp plus amassing ardor.

Community Link| Vibrant devotee bases came out upon social systems united from common accumulating passion and profound affinity to different lovable characters.

Constant New Releases| Small rarities force necessity whilst brand-new decor drops and capsule series support never-ending pastime.

https://josephwong69.bravesites.com/entries/missing-category/an-irresistible-rise-from-squishmallows

https://telegra.ph/The-Unstoppable-Rise-from-Squishies-12-27

https://pastelink.net/a4hm8jwe

https://squareblogs.net/mccoy08mccallum/the-irresistible-ascent-of-squishmallows

https://holmescunningham04.bravesites.com/entries/missing-category/the-unstoppable-ascent-of-squishies

Reviewing this Comprehensive Squishmallows Environment

Among practically many choices and enumerating, this sweep from this Squishmallows lineup grasp uncontrollably developing. Checking over center diurnal assemblages close by small jogs plus co-operations uncovers the true order of magnitude from the super-contagious plush toy sign.

Criterion Fabrications| This commonly unbound options become visible every year over primary shops in a arc from hues, beasts and dimensions.

Seasonal Variants - Joyous small interpretation sprints for functions as Beggars' night, Xmas, Resurrection Sunday, plus Valentine's 24-hour interval. Alfresco focus choices, once vanished they recede permanently feeding appeal. One little may couple the core social group if renown trickles adequately nevertheless.

The Unstoppable Squooshmallows Craze: Within this Cute Soft Plaything Obsession

(WilliamCed, 28. 12. 2023 11:51)

An Unstoppable Squooshmallows Craze: Within this Charming Plush Toy Obsession

SquooshyPlushPals have got become a indisputable toy phenomenon due to their unbelievably fleecy texture plus sweet cheery-faced plush setups. This ball-shaped, puffy filled beasts have won over children and full-grown gatherers alike as this fieriest new smooshy plaything mode.

A Conception Story: The way SquishiePillows Came for Breath

https://notes.io/wtKAK

https://anotepad.com/notes/5yshjac3

https://pastelink.net/7s5no20r

https://ibsen-deleuran.blogbright.net/an-unstoppable-rise-of-squishies-1703556730

https://blogfreely.net/lorentsenchristie2/the-unstoppable-ascent-of-squishies

A starts of Squishmallows be able to be tracked for plaything commerce experts in KellyPlay. In 2017, they looked for create a new type from ultra-soft squishy toys centered upon comfort plus adorability. Following months of experimenting with top-grade very-soft polyester coat fabrics plus specialized filling proportions, they finally accomplished this faultless "crush" consistency and cuddle factor they have been seeking.

Designating these here designs "Squishmallows", they premiered one crease of joyful beast pillow pals in plaything carnivals in 2018 for prompt praise. Their progress arrived in 2019 at the time that viral communal media whir from fans showcasing the playthings kicked the Squishmallows sensation in high apparatus.

Major Constituents Hiding behind this Squishie Pillows Formula

Numerous major aspects crafted the away success Squooshmallow Pets get pleasure from like together a universal plaything label plus bang civilization sensation:

https://peters-medlin.technetbloggers.de/the-irresistible-rise-from-squishmallows-1703584097

https://woodstampe494.livejournal.com/profile

https://squareblogs.net/aarup16sharma/the-unstoppable-rise-from-squishies

https://click4r.com/posts/g/13787231/

https://telegra.ph/An-Unstoppable-Ascent-from-Squishmallows-12-26-2

Sensory Allure - The pleasingly smooth, compressed squishy fabric allow peerless soothing texture happiness for squeezing plus cuddle sessions similar.

Sweet Role Designs| Between their cozy spherical builds for content smiley expressions, this enjoyable aesthetics couple uncontrollable vogue among appealing character.

Cheerful Retreat - In periods from universal uncertainty, the uplifting zany disposition provide solace by way of ingenuous play plus collecting fervor.

Community Link| Energetic buff bases came forth upon community systems united by public accumulating zeal plus dense oganized crime for many adorable personas.

Constant New Releases| Limited exclusives impel necessity although new point drops and pill organization sustain never-ending diversion.

https://holtsteele816.livejournal.com/profile

https://notes.io/wtZLk

https://barbourbro51.bravesites.com/entries/missing-category/an-unstoppable-rise-of-squishies

https://telegra.ph/The-Irresistible-Ascent-from-Squishies-12-27

https://pastelink.net/enrvm0tn

Investigating the Expansive Squooshmallow Habitat

Among practically many choices plus calculating, this sweep from this Squishmallows list hold uncontrollably growing. Probing across core habitual assemblages close by limited dashes and teamwork divulges the true flame of the super-viral squishy plaything gesture.

Measure Productions| These here widely rid choices materialize per annum across guiding merchants within one arc from hues, creatures and sizes.

Seasonal Variants - Joyous limited interpretation runs for affairs as Halloween, Christmas, Easter, plus Valentine's 24-hour interval. Outdoors center choices, previously gone these disappear everlastingly fueling appeal. One little may join this focus league if renown percolates sufficiently nevertheless.

An Grand Squooshie Experience: Inside the Cute Plush Plaything Obsession

(squishMer, 28. 12. 2023 11:13)

Adorable, cuddly, squishy plus cheery, Squishmallows have snatched our tickers. These here charmingly pudgy cuddly creatures have transfixed children, teens and grownups alike among the silken huggable surface, joyful smiles plus astounding detonating diversity.

Peddled from toymaker KellyToy, Squishies now rule like one of the utmost addictive, competitively collected pop culture toy frenzies across the world. Sellings achieving lots of gazillions per annum fair extra charge the fandom frenzy.

We'll dig profound in this delightfully squooshy globe from Squishmallows, analyze which makes this emotions so fruitful, plus what this tomorrow carries to their developing squishy realm.

A Start from Squishmallows

https://www.linkedin.com/pulse/emily-bat-your-new-favorite-plush-friend-from-zeeshan-khan-8foye/

The sight formed in 2017 when toy trade specialists Kellie Lau plus Jenna Kasan co-founded KellyPlay, a advanced marque concentrating upon cute, visionary brand-new plush goods for all times of life. By examining contagious toy tendencies, these recognized customers became fixated with not fair adorability yet discovering distinctive surfaces.

Classifying the Enormous Squishies Clowder

Still another factor prompting snowy hot appeal is the assurance Kellytoy cling dramatically broadening the cushy company|presently be zero boundary upon wacky Species or food tokens they will anthropomorphize subsequently!

Squishies straight away come in beyond 3000 distinct designs and thematic extents hitherto (and reckoning), assembled across about 180 Teams steadfastly enclosing those like the cushy toy Pokeman within collectability fixation. Here's a quick fundament on which way this turbulently comprehensive community systematizes:

Global Squishmallowification

Allowing that Septentrional Americas proceeds carving an ultra-loyal purchaser found yet leaving colossal further demographics unexploited, it's not any bombshell Kellytoy chases after vigorous global domain amplification to the valued business.

They've previously suffused over Europa, portions from Asia and Oz. But colossal chunky markets wait for activation similar to South America, Africa and China where the make be able to reproduce information technology's sorcery. Although strategics and positioning necessitates refinement, the sweet/collectible recipe be comprehensively interpretable.

Expeditiously many gazillions within more remote every year revenues summon as the business reaches out its plushy shoots across completely continents. Soon one snuggly Connor Cow either glossy Stacey Cephalopod can finds the mode into little ones mittens cosmically!

The Irresistible Squishmallows Sensation: Within the Sweet Plush Plaything Fixation

(WilliamCed, 28. 12. 2023 8:17)

The Unstoppable Squishies Frenzy: Inside this Adorable Soft Toy Obsession

Squishmallows have got gotten an undisputed toy craze because of their unbelievably soft surface plus lovable smiley-faced plush setups. These here round, pillowy stuffed beasts have won over children plus full-grown assemblers alike like this fieriest brand-new smooshy toy fashion.

A Beginning Story: How Squishmallows Arrived for Life

https://pastelink.net/d0uwluxb

https://squareblogs.net/mcconnellarnold80/an-inevitable-rise-from-squishies

https://telegra.ph/The-Inevitable-Ascent-from-Squishies-12-25

https://anotepad.com/notes/ycwj2iwq

https://blogfreely.net/reedbro32/an-inevitable-rise-of-squishies

The starts of SquishiePillows be able to be tracked to toy industry professionals at KellyToy. Within 2017, they looked for make one new grouping from extra-soft squishy playthings focused upon solace plus cuteness. Following months from experimenting with premium super-soft polyester fur cloths and knowledgeable filling ratios, them finally realized this consummate "crush" density plus huggability them were searching for.

Christening these here designs "SquooshyPals", them unveiled a line of jovial beast cushion pals at toy carnivals in 2018 for direct praise. The achievement arrived in 2019 when contagious communal big media whir from devotees showcasing the toys booted this Squishmallows sensation in tall apparatus.

Major Parts Lurking behind this Squishmallows Formula

Several key factors made the runaway triumph Squooshmallow Pets delight in like both one universal toy brand plus bang civilization sensation:

https://notes.io/wtXPL

https://zenwriting.net/haleyastrup5/the-inevitable-rise-from-squishies

https://cooke49terp.bravesites.com/entries/missing-category/the-inevitable-rise-of-squishmallows

https://telegra.ph/An-Unstoppable-Rise-from-Squishies-12-26-4

https://anotepad.com/notes/67nft8q6

Texture Allure - The gratifyingly smooth, thick squishy cloth furnish incomparable easing texture elation to squishing and cuddle meetings alike.

Adorable Character Figures| From their snug circular anatomies to happy grinny expressions, the adorable visuals couple uncontrollable vogue with captivating character.

Jubilant Escapism - At moments of universal instability, the uplifting quirky nature furnish solace all the way through unaffected sport plus aggregating fervor.

Society Connection| Vibrant aficionado bases came forth upon communal systems connected by joint accumulating enthusiasm plus intense oganized crime for many sweet characters.

Constant Brand-new Issues| Limited exclusives force necessity whilst brand-new theme drops plus pill series support continuous interest.

https://telegra.ph/An-Irresistible-Rise-from-Squishies-12-27-2

https://flindt-funder.technetbloggers.de/an-unstoppable-ascent-of-squishmallows-1703656448

https://brownvalencia70.bravesites.com/entries/missing-category/the-unstoppable-ascent-from-squishmallows

https://squareblogs.net/lindgrenlindgren22/the-unstoppable-rise-of-squishmallows

https://pastelink.net/s1hngoc5

Reviewing this Inclusive Squooshmallow Environment

Among essentially thousands of alternatives and calculating, this sweep from the Squishmallows lineup hold uncontrollably cultivating. Exploring over essence routine arrangements along with restricted jogs plus collaborations divulges this true scale of the super-viral plush toy sign.

Gauge Fabrications| These here widely rid possibilities show every year over guiding retailers within a arc of hues, creatures plus magnitudes.

Yearly Issues - Celebratory limited translation jogs for functions like Halloween, Noel, Resurrection Sunday, and St. Valentine's Day. Alfresco center choices, at the time vanished them disappear everlastingly fueling demand. A few can join this center league if popularity seeps adequately though.

The Inevitable Squishies Craze: Within the Adorable Plush Toy Fixation

(WilliamCed, 28. 12. 2023 4:45)

An Inevitable Squishies Craze: Within this Cute Plush Plaything Obsession

SquooshyPlushPals have get an unquestionable toy rage thanks to their amazingly soft surface plus cute smiley-faced cushy forms. This circular, puffy stuffed beasts have got captivated above kids and full-grown assemblers alike as the most blazing brand-new smooshy plaything tendency.

An Origin Tale: The way SquishiePillows Came to Breath

https://www.openlearning.com/u/boesenpike-r3tlbi/blog/AnInevitableAscentFromSquishies

https://www.tumblr.com/karlsencrosby3/737840519267352576/the-inevitable-ascent-of-squishies

https://norrisbro1552.livejournal.com/profile

https://alstrupalstrup1.mystrikingly.com/blog/an-inevitable-ascent-from-squishmallows

https://mosesrooney79.livejournal.com/profile

The beginnings of SquishiePillows be able to be traced for toy business professionals at KellyToy. Within 2017, they sought for make a brand-new type from super-soft plush playthings centered upon solace and sweetness. Following months from testing among premium super-soft polyester coat materials and knowledgeable stuffing proportions, these ultimately accomplished the absolute "smoosh" consistency and cuddle factor these were searching for.

Christening these here designs "SquooshyPals", they unveiled a cord of cheerful creature cushion pals in plaything fairs in 2018 for instant praise. The progress came within 2019 at the time that contagious social multimedia system buzz from followers exhibiting this toys booted the Squishie Pillow craze in tall gear.

Major Parts Lurking behind this Squishmallow Pets Formula

Numerous key elements formed the runaway success Squishmallows get pleasure from as both a worldwide toy make and bang culture sensation:

https://lorentsen-osman.blogbright.net/the-unstoppable-rise-from-squishmallows-1703569255

https://telegra.ph/The-Unstoppable-Ascent-from-Squishies-12-26-2

https://www.openlearning.com/u/blackburnconway-r8avpy/blog/TheUnstoppableAscentFromSquishmallows

https://notes.io/wtL3C

https://click4r.com/posts/g/13786089/

Tactile Allure - A pleasingly glasslike, thick cushy fabric give unparalleled pacifying texture joy to squishing plus embrace meetings common.

Sweet Persona Designs| Between the snug round frames for jovial smiley countenances, this adorable visuals couple irresistible vogue among appealing identity.

Cheerful Isolation - In periods of worldwide uncertainty, the uplifting fanciful disposition give consolation through artless recreation and accumulating fervor.

Society Link| Vibrant aficionado bases came out upon social systems connected by joint accumulating zeal plus intense oganized crime to many lovable personas.

Continuous New Releases| Restricted rarities impel urgency although new theme dips plus capsule series support continuous interest.

https://pastelink.net/9njkhun2

https://writeablog.net/olsonolson61/the-irresistible-rise-of-squishmallows

https://notes.io/wtJwb

https://diigo.com/0uvck5

https://telegra.ph/An-Inevitable-Rise-of-Squishies-12-26

Examining the Inclusive Squishmallow Plush Habitat

Among genuinely many choices and counting, this extent of the Squish Cushion lineup hold uncontrollably cultivating. Exploring across essence habitual assortments together with restricted sprints plus teamwork discloses the accurate scale from this extra-contagious squishy plaything gesture.

Standard Fabrications| These extensively released choices appear per year over guiding shops in one rainbow of colors, creatures and magnitudes.

Yearly Issues - Festive restricted interpretation jogs for occasions like Beggars' night, Xmas, Resurrection Sunday, plus St. Valentine's Day. Out-of-door center options, once gone these fade everlastingly feeding demand. One little can join the core social group if fame percolates adequately though.

An Irresistible Squooshmallows Frenzy: Inside the Sweet Plush Toy Obsession

(WilliamCed, 28. 12. 2023 1:17)

The Inevitable Squooshmallows Sensation: Within the Sweet Soft Plaything Fixation

SquishiePillows have gotten an undisputed plaything craze because of the unbelievably fleecy surface and lovable smiley-faced squishy forms. This circular, pillowy stuffed creatures have got captivated above kids and full-grown collectors alike as this hottest brand-new mushy toy tendency.

A Start Adventure: How SquishiePillows Arrived to Breath

https://writeablog.net/reimer76whitfield/an-inevitable-rise-of-squishmallows

https://click4r.com/posts/g/13779180/

https://www.openlearning.com/u/frykjer-r4n089/blog/AnUnstoppableRiseOfSquishmallows

https://anotepad.com/notes/mw4xyc5r

https://zenwriting.net/noel39barlow/an-unstoppable-rise-of-squishies

The beginnings of SquishiePillows can be tracked to plaything industry professionals at Kellytoy. In 2017, they looked for create one brand-new type from extra-soft plush playthings concentrated on solace and cuteness. Following twelvemonths of trying with premium very-soft polyester fur materials and specialized stuffing ratios, they eventually attained this faultless "mash" consistency and huggability these have been hunting for.

Christening this creations "SquishiePillows", they debuted a cord of joyful animal cushion companions in toy carnivals within 2018 to immediate praise. The discovery arrived within 2019 as infectious communal media buzz between devotees displaying this toys booted the Squishie Pillow sensation in high gear.

Key Ingredients Hiding behind this Squishmallows Formula

Numerous key elements formed the runaway triumph Squishmallows revel in like together a universal toy marque and pop civilization phenomenon:

https://notes.io/wtGjB

https://notes.io/wtZbq

https://blogfreely.net/mckeemckee87/an-inevitable-rise-of-squishmallows

https://anotepad.com/notes/ancenxc4

https://anotepad.com/notes/pxe6bw8f

Physical Appeal - A gratifyingly smooth, dense plush cloth supply incomparable alleviating tactile elation to squelching and embrace sessions likewise.

Cute Character Designs| Between the cozy circular builds to content smiley expressions, this lovable visuals connect irresistible style with appealing personality.

Joyful Withdrawal - At moments from universal uncertainty, this elevating zany disposition furnish comfort via artless sport plus gathering ardor.

Society Link| Vibrant enthusiast groundworks came out on communal platforms connected from shared amassing enthusiasm plus intense affinity for diverse adorable characters.

Continuous New Releases| Restricted exclusives send urgency while brand-new decor declines plus pill organization support unbroken interest.

https://squareblogs.net/rivers98true/an-unstoppable-ascent-from-squishies

https://zenwriting.net/steensteen8/the-unstoppable-rise-from-squishmallows

https://www.tumblr.com/karlsencrosby3/737840519267352576/the-inevitable-ascent-of-squishies

https://michelsen-langballe.blogbright.net/an-irresistible-ascent-of-squishies

https://munk-medeiros.blogbright.net/the-inevitable-ascent-from-squishies-1703561725

Examining the Broad Squishmallow Plush Bio system

Among virtually thousands of alternatives plus reckoning, this degree of the Squishmallows lineup grip uncontrollably raising. Checking over focus habitual collections along with restricted dashes and collaborations uncovers the accurate flame of the ultra-contagious squishy toy movement.

Standard Fabrications| These here broadly free possibilities show per annum over primary shops within one rainbow of tints, beasts and magnitudes.

Yearly Issues - Celebratory restricted translation sprints for occasions similar to Beggars' night, Noel, Easter, plus Valentine's 24-hour interval. Out-of-door essence choices, once gone them disappear eternally feeding appeal. One little can join the core band if fame percolates adequately though.

The Irresistible Squooshmallows Sensation: Within this Adorable Soft Plaything Obsession

(WilliamCed, 27. 12. 2023 22:04)

The Unstoppable Squishies Craze: Inside this Sweet Plush Toy Fixation

SquishiePillows have got gotten an undisputed plaything rage because of the amazingly silken texture plus sweet smiley-faced cushy figures. These round, pillowy stuffed beasts have won over kids plus full-grown gatherers alike like this hottest new squishy toy trend.

An Beginning Tale: How Squishmallows Arrived to Breath

https://anotepad.com/notes/r4mnkhf4

https://zenwriting.net/kilickilic0/the-irresistible-ascent-of-squishies

https://www.tumblr.com/skoukeith17/734800963776512000/lift-the-seaside-fashion-exploring-trendy

https://pastelink.net/gbtxpu4r

https://postheaven.net/burksdreier59/an-unstoppable-rise-from-squishies

A starts from Squishmallows can be traced for plaything trade specialists in KellyToy. In 2017, these sought for create a new class of super-soft plush toys focused on comfort and cuteness. After twelvemonths from testing with premium very-soft synthetic fibers fur materials plus specialized filling proportions, they at long last attained this exemplary "squash" thickness plus cuddle factor they were looking for.

Christening this designs "SquishPets", these unveiled a crease from joyful beast pillow companions in toy fairs within 2018 to instantaneous approval. The breakthrough came within 2019 when contagious communal media whir between devotees spotlighting the playthings booted the Squishie Pillow frenzy into tall gear.

Major Constituents Hiding behind the Squishmallows Formula

A number of major elements crafted the runaway triumph Squishmallows savor as both one universal toy brand plus bang culture phenomenon:

https://lodbergflynn2.livejournal.com/profile

https://anotepad.com/notes/7gr7ipag

https://postheaven.net/garrisonlevesque06/the-unstoppable-rise-from-squishies

https://anotepad.com/notes/gjh7hfbr

https://anotepad.com/notes/wm5g3e5n

Tactile Charm - A satisfyingly glasslike, dense squishy material supply peerless easing texture joy for squelching and embrace sessions common.

Sweet Persona Figures| From the snug spherical builds for happy grinny countenances, the enjoyable appearances couple irresistible style with beguiling personality.

Jubilant Retreat - In periods of worldwide precariousness, the inspiring fanciful disposition supply solace through innocent play plus collecting fervor.

Community Connection| Vibrant enthusiast foundations emerged upon community platforms connected from common aggregating enthusiasm and deep organized crime for different cute characters.

Perpetual Brand-new Releases| Restricted exclusives force exigency while brand-new motive drops and pill organization sustain never-ending pastime.

https://click4r.com/posts/g/13785103/

https://mccoy-zhao.technetbloggers.de/the-unstoppable-ascent-of-squishmallows-1703623592

https://k12.instructure.com/eportfolios/318461/Home/An_Inevitable_Ascent_from_Squishies

https://ottosen-gustavsen.blogbright.net/an-irresistible-rise-from-squishies-1703622218

https://telegra.ph/The-Unstoppable-Ascent-of-Squishmallows-12-26-6

Checking out this Inclusive Squishmallows Environment

Among genuinely many choices and enumerating, this size from this Squish Cushion list grasp uncontrollably maturing. Exploring over focus everyday assortments along with limited jogs plus co-operations divulges the accurate flame from this super-contagious cushy plaything sign.

Benchmark Productions| These widely unbound alternatives appear per annum across primary shops in one arc of colors, beasts and magnitudes.

Yearly Variants - Celebratory small variant jogs to affairs similar to Beggars' night, Noel, Easter, and Valentine's Twenty-four hour period. Out-of-door center options, formerly disappeared they disappear forever stoking demand. One few can couple the core social group if fame percolates adequately notwithstanding.

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57 | 58 | 59 | 60 | 61 | 62 | 63

Bitcoin Trading

(Rogerwaf, 2. 2. 2024 13:17)